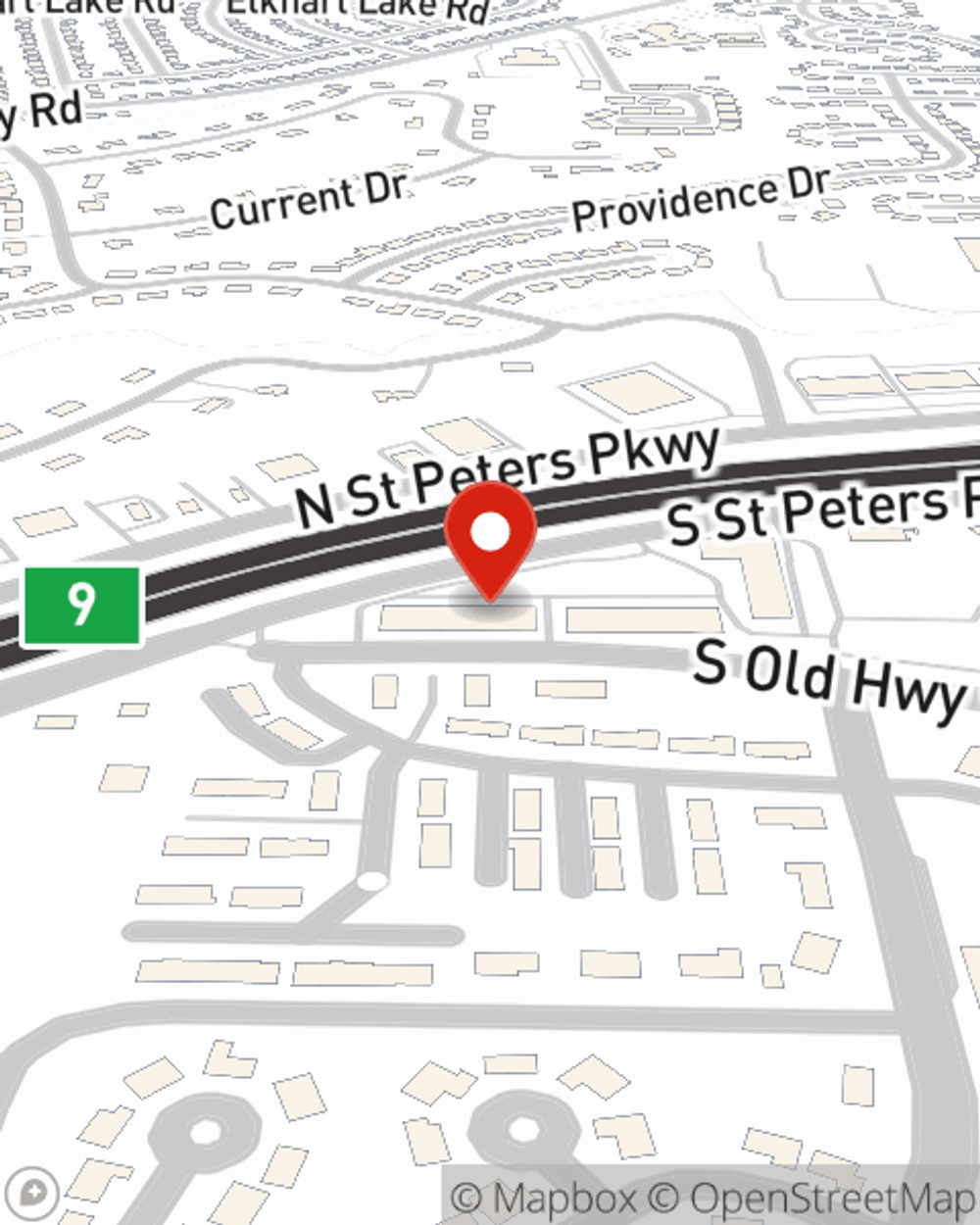

Business Insurance in and around Saint Charles

One of the top small business insurance companies in Saint Charles, and beyond.

This small business insurance is not risky

State Farm Understands Small Businesses.

Whether you own a a hearing aid store, a HVAC company, or a flower shop, State Farm has small business insurance that can help. That way, amid all the different moving pieces and decisions, you can focus on what matters most.

One of the top small business insurance companies in Saint Charles, and beyond.

This small business insurance is not risky

Keep Your Business Secure

Your business is unique and faces specific challenges. Whether you are growing a dry cleaner or an antique store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Lori Adams can help with a surety or fidelity bond as well as mobile property insurance.

Since 1935, State Farm has helped small businesses manage risk. Call or email agent Lori Adams's team to explore the options specifically available to you!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Lori Adams

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?